A balanced scorecard evaluates the performance of senior management not only through the finance perspective. It allows managers to look at the business from four important perspectives.

From the perspectives of financial sustainability, customer experience, processes (internal process), and employees (learning and growth).

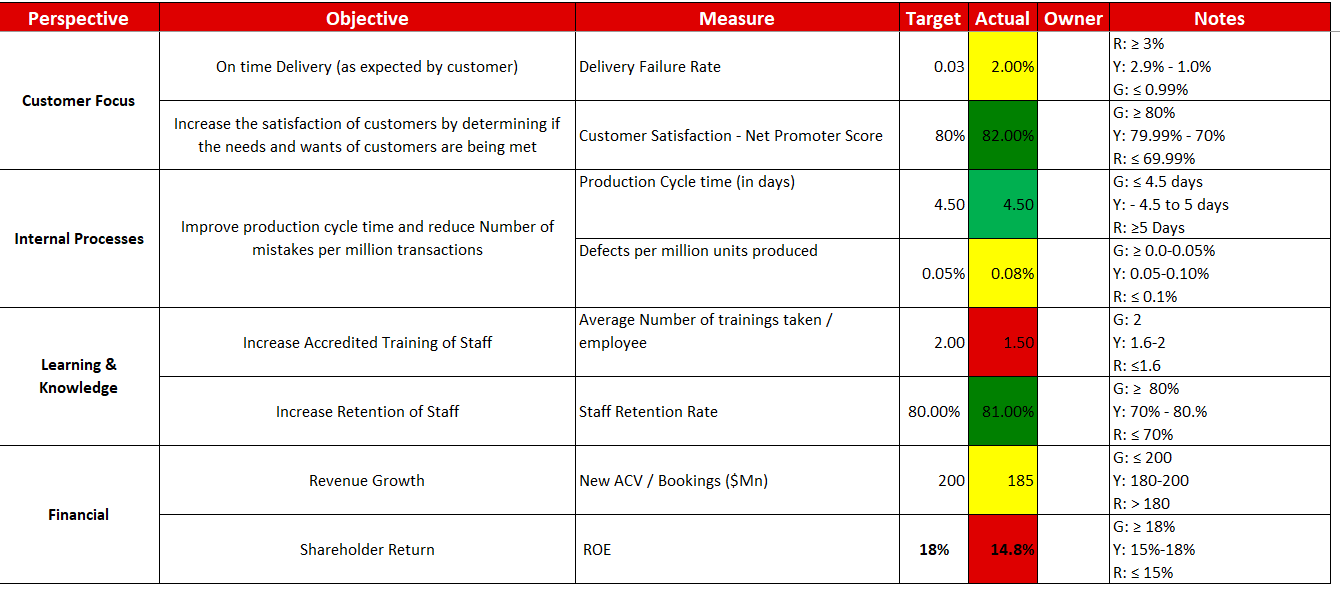

Typical format of a balance scorecard

It provides answers to four basic questions:

-

How do customers see us? (Customer perspective)

-

What must we excel at? (Internal perspective)

-

Can we continue to improve and create value? (Innovation and learning perspective)

-

How do we look to shareholders? (Financial perspective)

Customer Perspective: How Do Customers See Us?

Many companies today have a corporate mission that focuses on the customer. “To be number one in delivering value to customers” is a typical mission statement.

How a company is performing from its customers’ perspective has become, so, a priority for top management.

The balanced scorecard demands that managers translate their general mission statement on customer service into specific measures that reflect the factors that really matter to customers.

Customers’ concerns tend to fall into four categories: time, quality, performance and service, and cost. Lead time measures the time required for the company to meet its customers’ needs.

Internal Business Perspective: What Must We Excel at?

The second part of the balanced scorecard gives managers that internal perspective.

The internal measures for the balanced scorecard should stem from the business processes that have the greatest impact on customer satisfaction—factors that affect cycle time, quality, employee skills, and productivity.

For example, companies should also try to find and measure their company’s core competencies, the critical technologies needed to make sure continued market leadership.

Companies should decide what processes and competencies they must excel at and specify measures for each.

Innovation and Learning Perspective: Can We Continue to Improve and Create Value?

The customer-based and internal business process measures on the balanced scorecard identify the parameters that the company considers most important for competitive success. But the targets for success keep changing.

Intense global competition requires that companies make continual improvements to their existing products and processes and can introduce entirely new products with expanded capabilities.

A company’s ability to innovate, improve, and learn ties directly to the company’s value. That is only through the ability to launch new products, create more value for customers, and improve operating efficiencies continually can a company penetrate new markets and increase revenues and margins—in short, grow and thereby increase shareholder value.

Financial Perspective: How Do We Look to Shareholders?

Financial performance measures show whether the company’s strategy, implementation, and execution are contributing to bottom-line improvement.

Typical financial goals have to do with profitability, growth, and shareholder value.

For example, measures include cash flow, quarterly sales growth, operating income by division, increased market share by segment, return on equity etc.

To conclude, the Balanced Scorecard suggests that we examine an organization from four different perspectives – Financial (or Stewardship), Customer/Stakeholder, Internal Process and Organizational Capacity (or Learning & Growth).