The success of every organization largely depends on its finance teams.

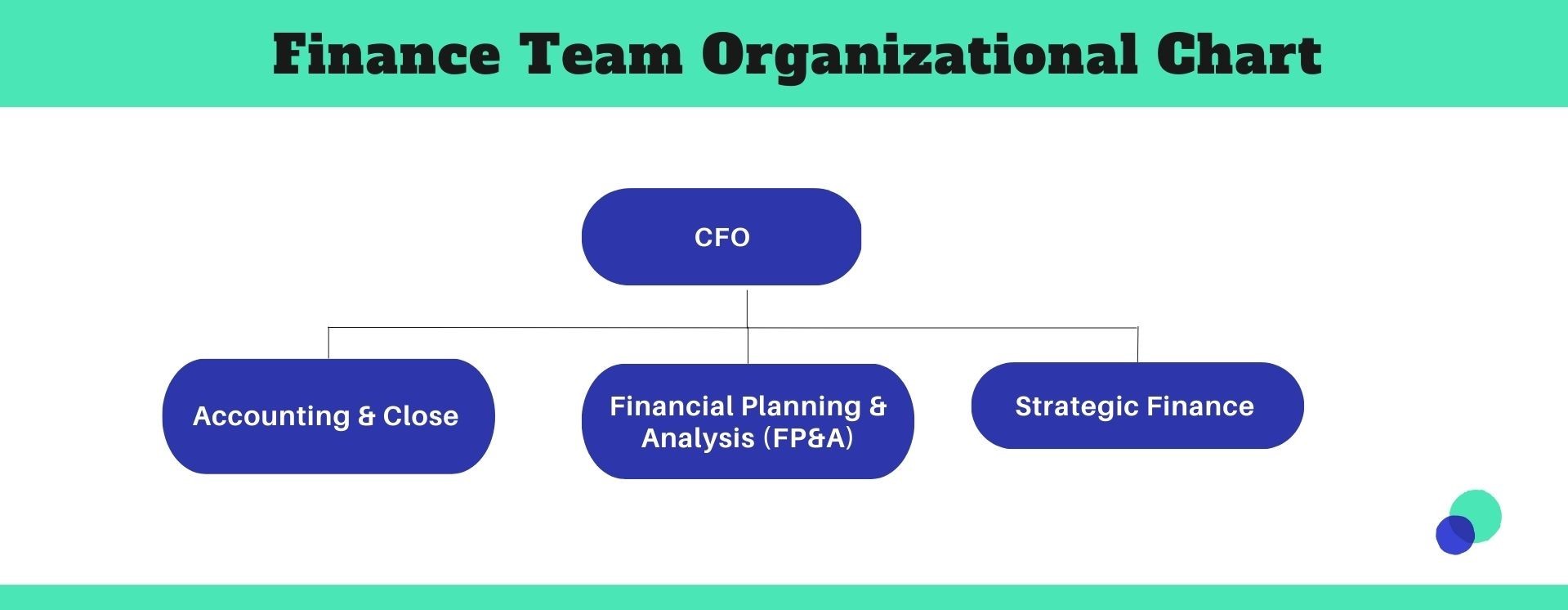

Finance team arrangements have gotten more and more sophisticated in today’s fast-paced world. In finance, there are three main teams: Financial Planning and Analysis (FP&A), Consolidation and Close, and Strategic Finance.

Although each of these teams has a specific function, organizations need to be aware of their various distinctions.

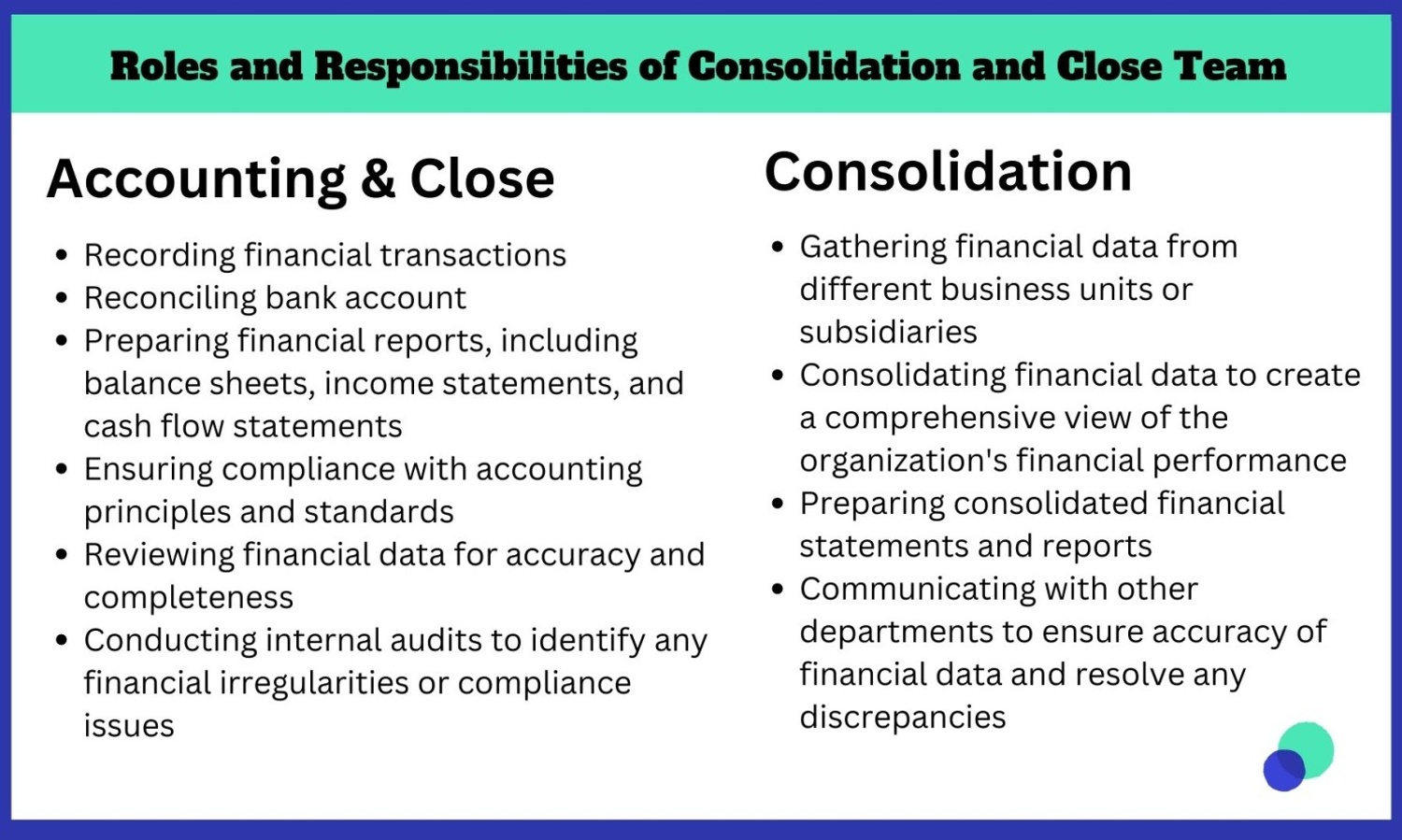

Consolidation & Close teams

are responsible for accounting and reporting financial information, ensuring accuracy and compliance with accounting standards.

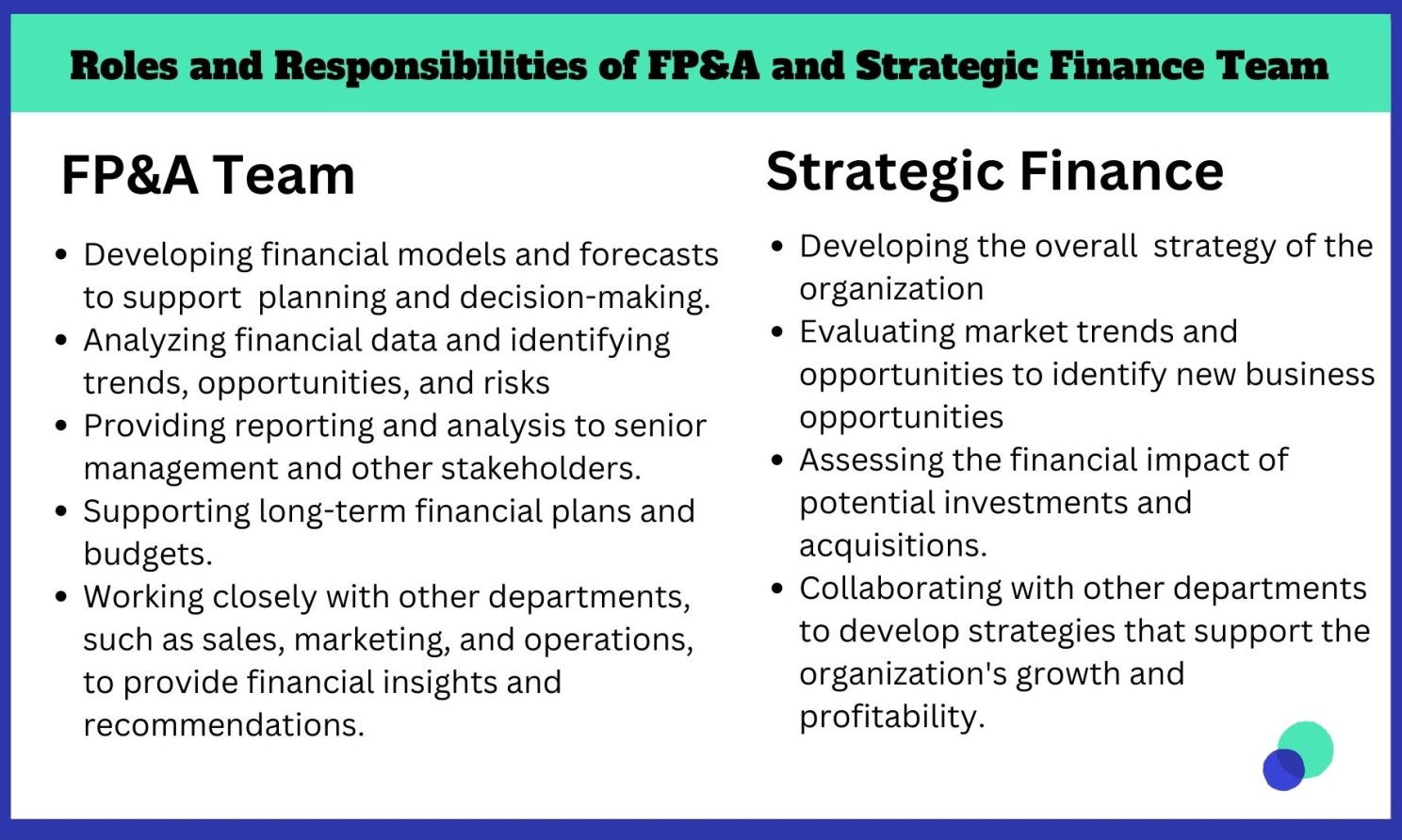

FP&A teams are responsible for budgeting, forecasting, and management reporting.

Strategic Finance teams focus on long-term financial planning and work with senior management to develop financial strategies aligned with the company’s goals.

Common Challenges

-

Data Accuracy and Completeness. All three teams require accurate and complete data to make informed decisions.

-

Timeliness of Reporting. All three teams face the challenge of producing timely and relevant financial reports. So they can support senior management in decision-making.

-

Communication. Communication between these teams and with business partners is crucial. This is to ensure that everyone is working towards the same goals and objectives.

How FP&A, Strategic Finance, and Consolidation teams work together

-

Collaboration. All three teams must collaborate. And ensure that the financial information produced is accurate, timely, and relevant.

-

Data Sharing. These teams must share data with each other. And ensure that everyone has access to the same information. So that senior management can make informed decisions.

-

Common Goals. They all work towards the common goal. Which is improving the financial health of the organization and supporting management decision-making.

-

Continuous Improvement. They are all committed to improving the financial management and reporting processes. And ensure that the organization operates effectively.

For access to the full text of my article, head over to Pigment‘s expert series blog.

About Pigment:

Pigment is a user-friendly Integrated Business Planning Platform with powerful modeling capabilities that enables organizations to plan faster and make data-driven decisions.