FP&A Storytelling has been one of the biggest trends in FP&A over the last few years as executives and C-level leaders want to know how their company is performing, what segments are performing well or not so well, and why so.

“To find signals in data, we must learn to reduce the noise – not just the noise that resides in the data, but also the noise that resides in us” – Stephen Few, Author, Thought leader.

FP&A Storytelling is the art of using financial and other data to tell a story that resonates with stakeholders. It helps in presenting the company’s financial performance in the form of a story that gets the point across in a memorable way and helps influence the desired action. It integrates the power of storytelling and reporting. A story is more than a spreadsheet or a presentation and as FP&A professionals we must present a story in a compelling way that influences the desired action.

“The key to using analytics is extracting insights that drive effective decision making and storytelling works as a lever to get the most out of those insights” – John Sanchez, FP&A Trends Author

We tell stories to entertain, to sell, to educate and to share financial insights. Many people are faced with the decision of using PowerPoint presentations to show their financial insights. When you can choose between PowerPoint presentation and storytelling, there are plenty of benefits to using both.

Understanding some universal plots (common plots that exist in every story) can be useful. Here are some examples

-

Overcoming the monster (David and Goliath; Tesla)

-

The Quest (The lords of the rings, Twitter)

-

Rags to Riches (Wolf of Wall Street ; startups)

-

Voyage and Return (Back to the future; Apple)

-

Comedy (Airplane; Paypal)

-

Tragedy (Hamilton; Kodak)

-

Rebirth (Groundhog day; Phillip Morris)

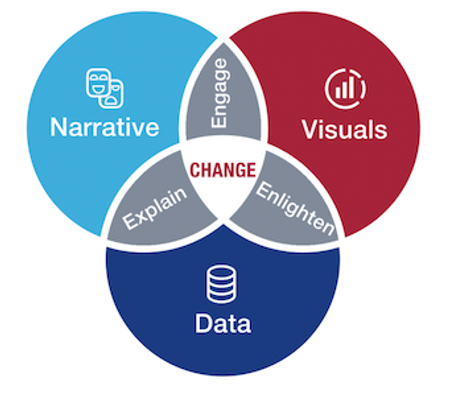

The 3 Building Blocks of FP&A Storytelling:

1. The Narrative – Knowing your business and the decision thought process is critical to drafting any story.

2. The Visuals – Leveraging the power of data visualization can help uncover insights that could have otherwise been missed.

3. The Data – It is the foundation on which FP&A storytellers build their narratives.

Our focus as storytellers should be on our audience, their needs and insights.

1. It is important to understand your audience – who are you communicating to?

2. What are the audience’s most essential needs

3. Insight – what’s the business issue, decision or action that’s needed?

Conclusion: To become a good storyteller it is important . .

1. Knowing your audience and tailoring the stories to your audience’s needs.

2. Structuring facts and numbers into a story and adding emotions. It will not only help your story to be remembered, but you will be remembered as well.

3. Knowing your business and being curious to understand your value drivers.

4. You don’t need to have all the data reconciled. You can still tell a story focussing on the key data points.

5. Be a journalist for your organization. Share condensed visualizations of data along with a lot of comments and recommendations.

In conclusion, FP & A stories are one of the most powerful forms of organizational communication. By putting a narrative behind the numbers and telling compelling stories finance can influence our stakeholders’ thinking and motivate them to take the desired action.

Credits: Olga Rudakova, Tanbir Jasimuddin, Veronica Lopez, and Michael Lengenfelder